Om Malik found an interesting comparison between Walmart and Amazon.com in Scott Devitt’s recent analysis of Amazon.com.

Here’s the excerpt:

In 1991, Walmart reported revenue of ~$44B, an increase of 35% over the prior year. In 2011, we estimate Amazon.com will report revenue of $49B, an increase of 43% over the prior year. Amazon.com is the Walmart of our era but it’s better, in our view – Amazon.com is the combination of a technology + logistics company, allowing it to participate in a transition of physical to digital retail supported by a store-less (in Seattle) business model that leads to higher long-term economic returns. (Morgan Stanley Research)

Amazon.com’s year over year growth is impressive. However, a more carefully scrutinized ratio is their operating margin, which fell from 3.3% in Q1 to 2% in Q2. These razor thin margins put Amazon.com in the same ballpark as notoriously thin grocery store margins.

Now I know what you’re thinking, how does Amazon.com’s operating margins compare to Walmart? Stefan Sidahmed over at Seeking Alpha has done a fantastic job of breaking down this analysis.

But the real story here is about innovation. The reason Amazon.com is operating off of thin margins is because they’re investing heavily and aggressively in new technologies. In one of my favorite letters to shareholders, Amazon.com CEO Jeff Bezos eloquently explains why his company is investing so aggressively right now.

Walmart is no stranger to offline innovation. They’ve perfected a brilliant distribution and supply chain system that is the envy of the world. However, online innovation has been a major weakness for them.

Walmart has recently acquired a social media categorization and semantic search company called Kosmix. Kosmix will be transformed into the new Walmart Labs division and will give Walmart its first foothold in Silicon Valley.

It’s exciting to watch these two companies innovate. Amazon.com clearly has the lead in eCommerce and online innovation. Walmart will need to do much more with Walmart Labs if it’s to seriously compete online.

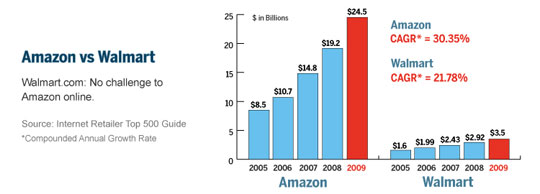

I’ll leave you with this chart from a few years ago. It still holds true today and demonstrates the online distance between Walmart and Amazon.com.